Renters Insurance in and around Belton

Welcome, home & apartment renters of Belton!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Belton

- Raymore

- Peculiar

- Lees Summit

- Grandview

- Greenwood

- Harrisonville

- Freeman

- Cleveland

- Pleasant Hill

- Lake Winnebago

- Blue Springs

- Independence

- Kansas City

- Martin City

- Archie

- Adrian

- Bucyrus, KS

- Overland Park, KS

- Leawood, KS

- Loch Lloyd

- Stanley, KS

- Stilwell, KS

- Louisburg, KS

Protecting What You Own In Your Rental Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented townhouse or condo, renters insurance can be the right next step to protect your valuables, including your entertainment center, furniture, microwave, silverware, and more.

Welcome, home & apartment renters of Belton!

Renting a home? Insure what you own.

Why Renters In Belton Choose State Farm

Renting a home is the right decision for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that doesn't include your personal belongings. Renters insurance helps protect your personal possessions in case of the unexpected.

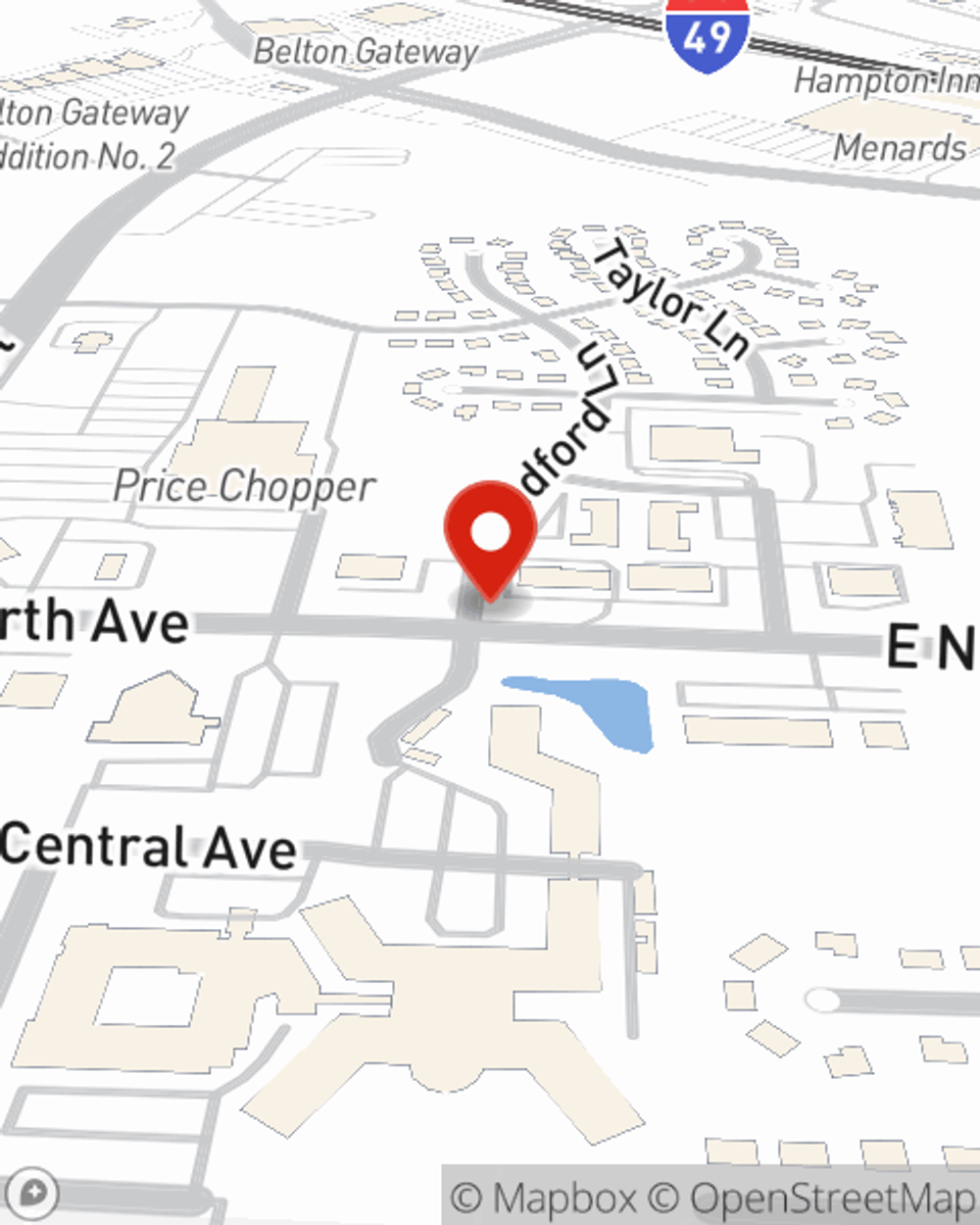

More renters choose State Farm® for their renters insurance over any other insurer. Belton renters, are you ready to learn how you can protect your belongings with renters insurance? Contact State Farm Agent Mark McBride today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Mark at (816) 348-7575 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Mark McBride

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.