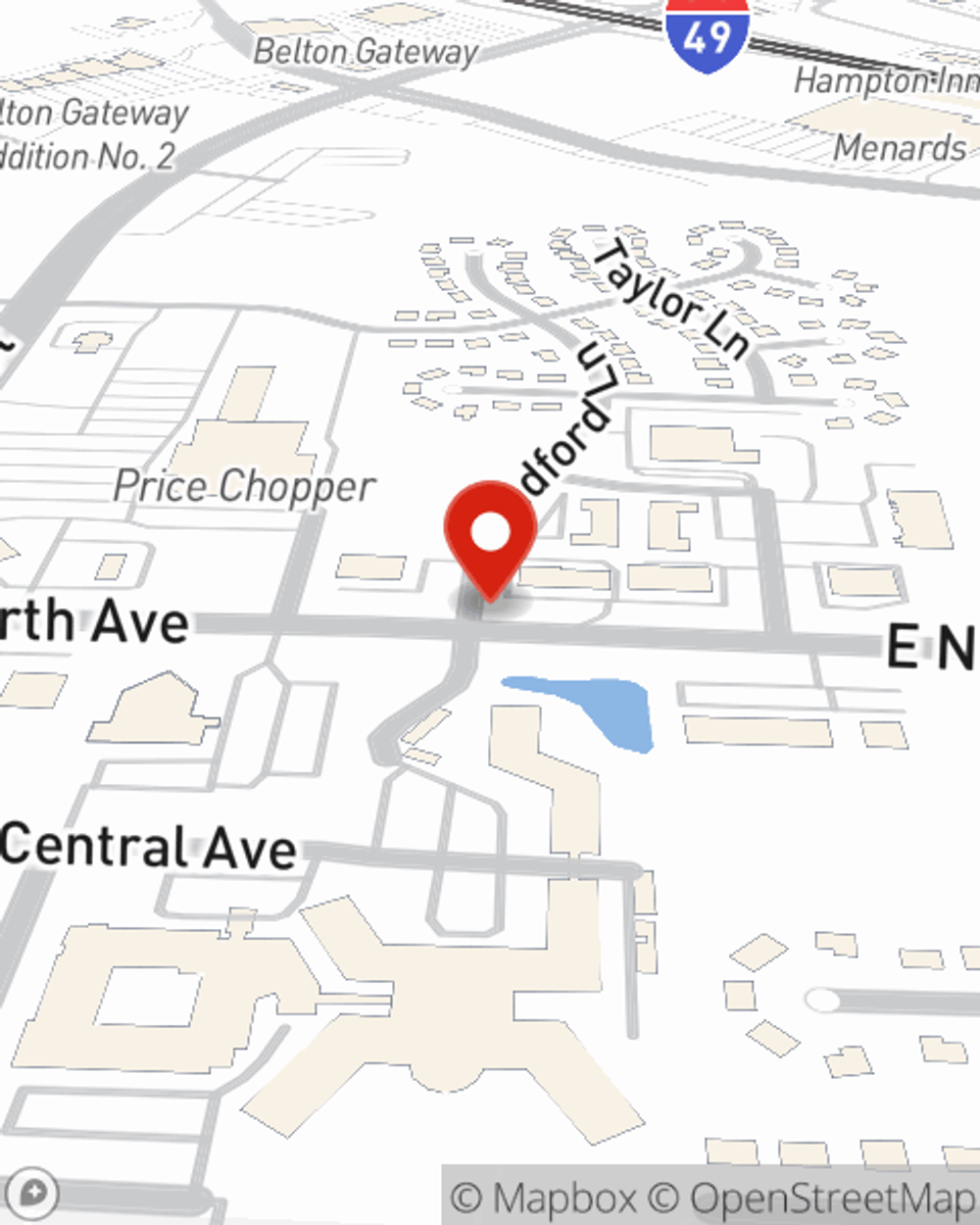

Business Insurance in and around Belton

Researching insurance for your business? Search no further than State Farm agent Mark McBride!

No funny business here

- Belton

- Raymore

- Peculiar

- Lees Summit

- Grandview

- Greenwood

- Harrisonville

- Freeman

- Cleveland

- Pleasant Hill

- Lake Winnebago

- Blue Springs

- Independence

- Kansas City

- Martin City

- Archie

- Adrian

- Bucyrus, KS

- Overland Park, KS

- Leawood, KS

- Loch Lloyd

- Stanley, KS

- Stilwell, KS

- Louisburg, KS

Cost Effective Insurance For Your Business.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, business continuity plans and a surety or fidelity bond, you can feel confident that your small business is properly protected.

Researching insurance for your business? Search no further than State Farm agent Mark McBride!

No funny business here

Keep Your Business Secure

Whether you own cosmetic store, a dry cleaner or a pottery shop, State Farm is here to help. Aside from fantastic service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Ready to consider the business insurance options that may be right for you? Call or email agent Mark McBride's office to get started!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Mark McBride

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.